A new survey done by MoneyWise shows two concerning things that could affect the housing market greatly. The first finding shows that more than 70% of all respondents felt pressure to lock in the rates, which could lead to a rise in buyers' remorse. The second key result of the survey is that American homeowners and aspiring home buyers know alarmingly little about the home buying process.

The survey was conducted on 1116 Americans, 727 non-homeowners, and the remaining 389 respondents who own at least one property. Questions about home purchase regret were imposed on homeowners only, but all 1116 respondents did the homebuying literacy quiz.

Who Is the Most Regretful?

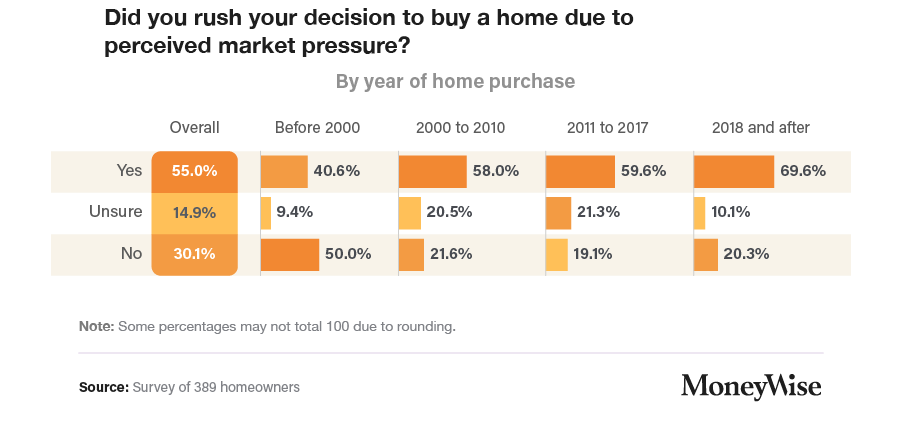

Out of all surveyed Americans, almost 400 respondents were homeowners and 70% of them felt like they rushed with the home purchase, because they felt pressured by the market. The majority of those 70% bought a house after 2018. This does not immediately mean that they are feeling regret, but it certainly increases the chances of feeling it in the future.

Out of all surveyed Americans, almost 400 respondents were homeowners and 70% of them felt like they rushed with the home purchase, because they felt pressured by the market. The majority of those 70% bought a house after 2018. This does not immediately mean that they are feeling regret, but it certainly increases the chances of feeling it in the future.

People regret not locking the fixed rates on their loans, as 78% of borrowers with adjustable-rate showed buyer remorse. Similarly, 71% of respondents who financed a house using a 15-year fixed-rate regret not taking a longer loan length. The slightest regret out of all categories showed people who took a 30-years fixed rate on a mortgage.

The questions about the down payment showed an interesting discrepancy between the non-homeowners and homeowners. Namely, when asked about the down payment, most non-homeowners said they would invest 6-12% of the asking price. However, almost 80% of homeowners told MoneyWise that they invested more than 20% of the asking price upon their first purchase.

How Much Do Homebuyers Know About Homebuying?

The main focus of the survey was to explore the level of homebuying financial literacy. MoneyWise asked its respondents to define some of the most common terms in the home buying process, such as closing costs, mortgage rate, and down payment.

The results show that 56% of all survey participants failed the quiz; most of them were people in their 20s. The term that caused the biggest confusion was mortgage rate, which was unfamiliar to more than 60% of questioned people. The term closing costs was seemingly the easiest to define. Baby boomers showed the most knowledge, while Gen X and Millennials had very similar results - always around 50%.

These results show that aspiring homebuyers and homeowners in America know alarmingly little about what is probably the biggest purchase of their life. Knowing these terms is a bare minimum for entering the process of spending hundreds of thousands of dollars, and being familiar with that process can save you a lot of money.

The survey dug a little deeper by exploring the sources that respondents use to stay informed about the housing market. Friends and family was the main answer in all age groups (61%), along with real estate professionals (58%) and online articles (47%). Gen Z has the same top three sources as everyone else, but many go to social media for information rather than taking homebuying courses or going to the bank.

What Story is This Survey Telling?

It should be taken into account that this survey tells the story of 1116 people and that there is always room for error. However, the pressure that homeowners felt when buying a home in the past 5-7 years may result in buyer’s remorse or even failure to make ends meet.

The quiz showed that the people who should be first-time buyers don’t particularly know what they are doing, which could subsequently lead to buyer’s remorse in the future. One of the ways to improve the housing market and make it favorable for regular buyers could be to educate them so they don’t fall victim to many manipulations and scams created by greedy sellers, brokers, and agents.

SELL

YOUR HOUSE

If you want to sell fast and are worried about how long the traditional process takes, and the commission and fees involved, consider working with SleeveUp Homes.

view all blogs by this author

view all blogs by this author Zachariah Peterson (69 blogs)

Zachariah Peterson (69 blogs)