Moody's Analytics Chief Economist Believes Home Prices Will Not Drop Significantly

June 13th, 2022 / Author: Cesar GomezIf we were to believe some real estate experts, we are living in a pivotal moment for the US housing market. There are optimistic and pessimistic predictions that don’t always align with one another, but all conclude the same: the prices in the housing market are overvalued.

Moody Analytics, an economic research company, measured local income levels against the local median home prices in 392 US metropolitan areas. Study shows that 96% of those areas have overvalued prices, 149 metros are overvalued by at least 25%, and the worst cases by far are along the Sun Belt.

Metros in California are moderately overpriced, with only three places 25% above the locals' possibilities. The most overvalued markets in California are San Diego and Santa Cruz, with 29%, and Los Angeles with 25% overvaluation in the housing market. The median price in California rose to $830.000, with some places, like Orange County, reaching a median price of seven figures.

Idaho’s Boise has the biggest gap between income and prices, with 73% above what the locals could afford. This doesn’t surprise given the fact that Californians have been moving away from the west coast to the inland - bringing the soaring prices with them.

Will the Market Dampen?

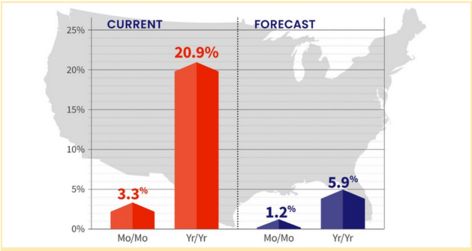

Source: CoreLogic

A researcher from Moody Analytics does not predict a significant decrease in homeowning costs. They expect a flattening of the prices and a zero price growth year over year 12 months from now. However, they are seeing that the rates are softening the prices and expect some overvalued markets to dampen.

Cities such as Phoenix, AZ and Nashville, TN, may see a 5%-10% decrease in prices. Rising rates and inflation will eat up a household’s budget, and people will not be able to compete in the market. Additionally, investors are demotivated and are slowly but surely leaving real estate to regular buyers. According to Moody Analytics, all of these factors will not create a national price decrease, but some local areas will feel it.

CoreLogic, another market researcher, does not predict that kind of price decline. On the contrary, they forecast 5.9% home price growth for the next 12 months. They define it as an indicator of deceleration, as the home prices have risen almost 20% over the past year. They are not predicting a bear market, but there seems to be a consensus that moderation of some kind is coming.

Why is the Housing Market Still Booming Regardless of the Rising Rates?

If we look back at the last five months, it seems like the housing market did not feel the rising rates. It was expected that there would be a cool-off, but it doesn’t feel like it, especially for the first-time buyers. Investors and corporations are still buying up properties and turning them into rentals, which only amplifies the lack of supply.

Some experts say that this unexpected boom is created by the last swing of motivated buyers who lock in the rates as fast as possible. The Fed announced the interest rate rise for the next two years, and the mortgage rate is already ahead. The most popular rate for housebuyers, the 30-years fixed-rate mortgage, surpassed 5.1%. To compare - it was below 3% a few months ago. Once the locking-in period stops, the market will have the time to cool off and soften.

SELL

YOUR HOUSE

If you want to sell fast and are worried about how long the traditional process takes, and the commission and fees involved, consider working with SleeveUp Homes.

view all blogs by this author

view all blogs by this author Zachariah Peterson (69 blogs)

Zachariah Peterson (69 blogs)