Home Sellers Drop Asking Price But It's Still a Seller's Market

June 13th, 2022 / Author: Cesar GomezSellers are decreasing their asking prices amid high mortgage rates and potential buyers leaving the real estate market. However, this is not lowering the competition significantly, and the mortgage rates put more pressure on the home buying budget. Housing inventory is as low as ever, with only $1.12 million homes on the market, and it is still around 3 million homes short for a balanced market.

Source: Redfin.com

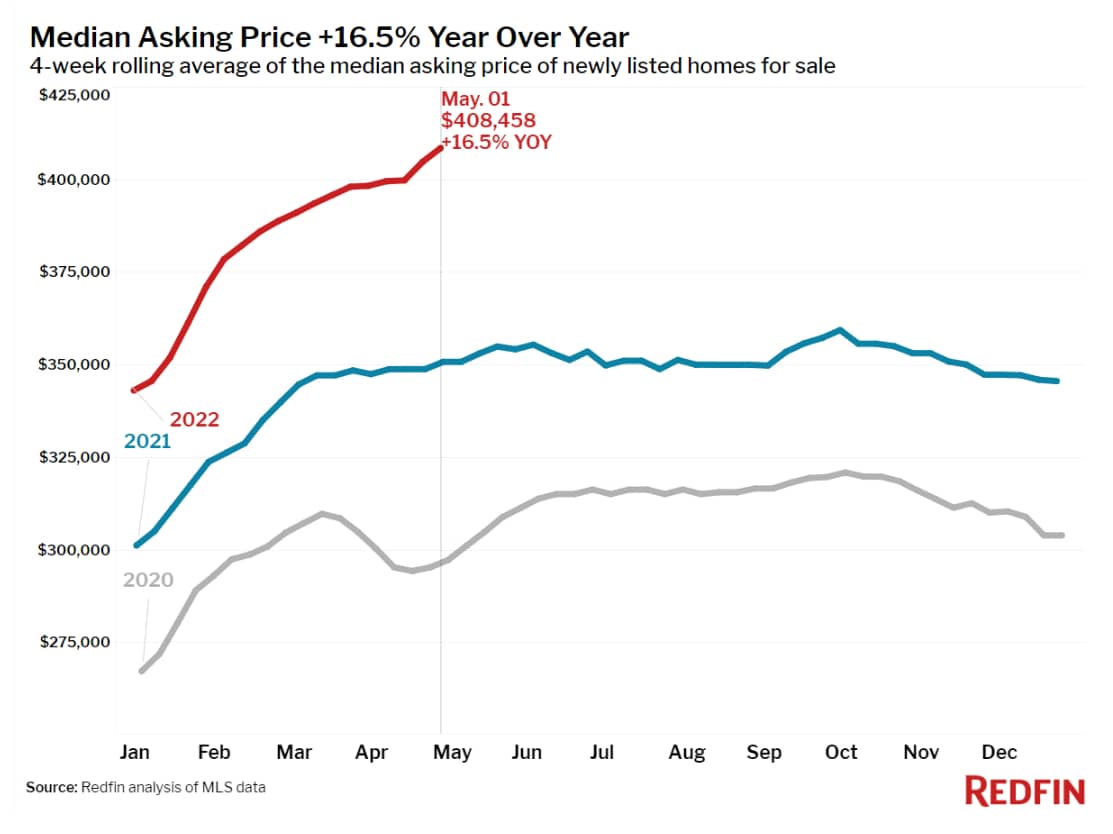

Redfin’s report shows that 15% of home sellers dropped the asking price in April. Meanwhile, the median asking price rose to a record-high $408,000.The mortgage rate for a 30-years-fixed surpassed 5%, and with it, the average monthly payment rose 42% year over year. The median home prices rose above $390,000. Those are the numbers that potential buyers find when entering the real estate market.

Why Are Home Prices Still High?

The housing market forecast implies that the market should be slowing down, but homebuyers are not catching a break. Mortgage interest rates are skyrocketing as a consequence of the Fed’s goal to fight inflation. Inflation is the highest it has been since the 1980s, and it is eating up most households’ budgets, making it hard to save up. On the other hand, housing inventory is so low that properties are still sold well above the asking price.

This imbalance only goes to say that the significant number of 15% (of sellers dropping the asking price) isn’t as substantial, given the fact that the houses are still sold for five or six figures above the asking price. The real estate market is not favorable to home buyers who struggle to find a property in their price range.

So to answer the question - the lack of homes for sale is what keeps the prices so high. Active listings were low even before the pandemic, but they fell 18% since March 2021 to an all-time low. The US real estate market is in serious need of affordable housing.

Housing Market Predictions

What we can gather from looking at the real estate market reports in the last five months is that it is very volatile and uncertain. Some predict a housing crisis; others negate it, saying that the borrowers are regulated and able to pay their bills. The market cool-down that was expected is yet to happen.

There are signs of lost interest in home buying, Redfin reports. One of them is a 7% drop in Google searches for “homes for sale”. Another thing that could indicate disinterest in the real estate market is the Fannie Mae report about home buyers’ sentiment. This report shows that more than 75% of respondents think it is bad to buy a house.

Yet another sign of housing market uncertainty and potential cool-off is the 9% drop in Zillow’s stock. But even with all that data, real estate professionals are not as quick to make assumptions about the market’s future as they were a few months ago.

SELL

YOUR HOUSE

If you want to sell fast and are worried about how long the traditional process takes, and the commission and fees involved, consider working with SleeveUp Homes.

view all blogs by this author

view all blogs by this author Zachariah Peterson (69 blogs)

Zachariah Peterson (69 blogs)